Technology

Alexa, how much is it?

Technological progress is making inflation statistics an unreliable guide to the economy

技术

Alexa,多少钱?

技术进步使通货膨胀统计数据无法可靠地指导经济

AMAZON IS USED to fielding accusations: that it has killed off physical retail business, that it mistreats warehouse workers, that it abuses its dominant platform in online sales. So perhaps it is not a surprise that some people also blame it for low inflation. In 2017 Janet Yellen, then chair of the Federal Reserve, wondered aloud if cut-throat online competition might be stopping goods-producers raising prices even in a world of rising demand. Alberto Cavallo of Harvard Business School has found that Amazon’s prices are 6% lower than those of eight large retailers, and 5% lower than on those retailers’ websites. The internet in general is no place to go in search of inflation: in America online prices have been falling fairly steadily since about 2012 and are lower than they were at the turn of the millennium.

亚马逊已经习惯于应付各种指控了:有说它扼杀了实体零售业务的,有说它虐待仓库工人的,也有说它滥用了自己具支配地位的在线销售平台的。所以有人将低通胀也归咎于它也许就不足为奇了。2017年,时任美联储主席的珍妮特·耶伦(Janet Yellen)提出质疑:即使全球需求增长,激烈的在线竞争是否阻止了商品生产商提高价格。哈佛商学院的阿尔贝托·卡瓦洛(Alberto Cavallo)发现,亚马逊的价格比八家大型零售商的价格低6%,比这些零售商的网站的价格低5%。互联网总体上绝不是寻找通货膨胀的好地方:在美国,自2012年左右以来,在线价格一直在相当稳定地下降,比千年之交时还要低。

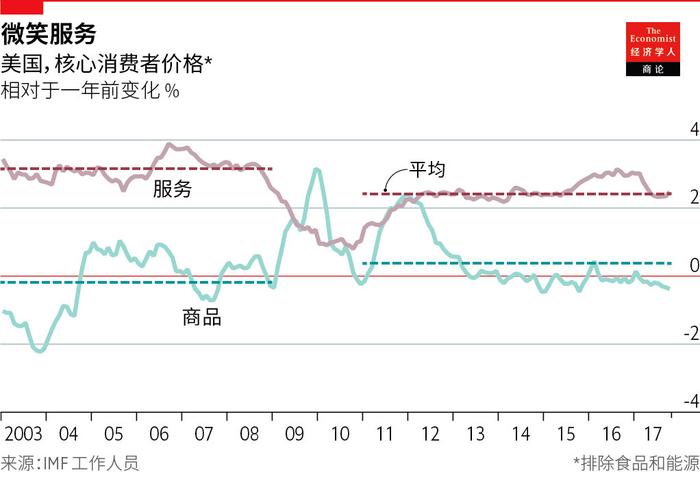

Yet the so-called “Amazon effect” should not seem so novel. The winds of disinflation have been blowing through American retail for decades. In the 1990s and 2000s big-box retailers like Walmart and Target ruthlessly cut goods prices as they optimised their supply chains. Cheap imports from China and other emerging-market economies squeezed domestic producers. One study in 2008 found that low-wage countries capturing 1% of market share in America was associated with a 3.1% fall in producer prices. There has been barely any cumulative rise in American consumer-goods prices, excluding food and energy, for two decades. Before the financial crisis, inflation as a whole behaved normally because services inflation held up. Today, both goods and services inflation are low (see chart). The rise of online retail does not easily explain that broader shift.

然而,这种所谓的“亚马逊效应”并不应该算是什么新鲜事。低通胀之风席卷美国零售业已经几十年了。在1990和2000年代,沃尔玛和塔吉特(Target)等大型零售商优化供应链,狠狠地降低了商品价格。来自中国和其他新兴市场经济体的廉价进口商品挤压了美国国内的生产商。2008年的一项研究发现,低薪国家在美国每多占1%的市场份额,生产者价格就下跌3.1%。20年来,不包括食品和能源在内的美国消费品价格几乎没有任何累积性上涨。在金融危机之前,在服务业通胀的支撑下,通货膨胀总体上表现正常。如今,商品和服务的通胀都很低(见图)。在线零售的兴起并不能轻易解释这一更广泛的转变。

Nonetheless, technological advance is a disinflationary force worth pondering. At a basic level, it allows an economy to produce more with its finite resources. If aggregate demand does not keep up, prices will fall—or at least not rise as fast. The idea that inflation has been low lately because productivity growth has been strong seems laughable everywhere except Silicon Valley because economic statistics have documented a global slowdown in productivity growth. Yet there is an argument that statisticians fail to capture some technological advances, making productivity seem lower and inflation higher than they really are.

尽管如此,技术进步是一个值得思考的引发通胀放缓的力量。从根本上讲,它让经济体利用有限的资源生产出更多的产品。如果总需求没有跟上,价格就会下跌——或至少不会以那么快的速度上涨。除在硅谷以外,由于生产率增长强劲而使得通胀一直保持低位的想法放在哪里似乎都很可笑,因为经济统计数据已经表明全球生产率增长放缓。不过,有一种论点是,由于统计学家未能捕捉到某些技术进步,使得生产率看起来低于实际,而通胀则高于实际。

The basic concern is a longstanding one. Because it takes a while for statisticians to notice that consumers are buying new products, they miss precipitous price falls early in a product’s life. It is also hard to tell how much better new products are than what went before. In today’s economy the missed value comes from smartphones, social media and online streaming. Spencer Hill, an economist at Goldman Sachs, recently calculated that the measured growth in consumption of personal electronics, communications and media was lower in the 2010s than in any of the five preceding decades. That was despite the fact that in 1990 it would have taken perhaps $3,000 to replicate even the basic functions of a modern phone—and only by using very bulky devices. In real terms, consumption in this category is surely soaring. The statistics must be missing something.

这种基本的担忧是长期存在的。由于统计人员需要一段时间才能注意到消费者开始购买新产品,他们就错过了产品在生命周期早期的价格骤降。新产品到底比以前好了多少也很难衡量。在当今的经济中,统计中错漏的价值来自于智能手机、社交媒体和在线流媒体。高盛的经济学家斯宾塞·希尔(Spencer Hill)最近计算出,2010年代测得的个人电子、通信和媒体消费增长低于过去五个十年中的任何一个。尽管有这样一个事实,那就是在1990年,要花上3000美元才能复制现代电话的基本功能,而且还得使用非常笨重的设备。按实值计算,这一类别的消费量肯定在飙升。统计肯定漏掉了什么东西。

Statisticians are constantly battling the problem. But a review of America’s inflation indices in 2018 by Brent Moulson, a former top government official, estimated that the inflation index targeted by the Fed remained upwardly biased by almost half a percentage point, primarily because of new products and quality changes. The shift to online sales could be making new-product bias worse. A paper by Austan Goolsbee and Peter Klenow of Stanford University found that even excluding clothing, for which tastes are fickle, 44% of online sales in a database produced by Adobe Analytics, a computing company, were of goods that did not exist in the prior year. With such high churn the basket of goods monitored by official statisticians would quickly go stale. Messrs Goolsbee and Klenow have, for some categories of goods, helped Adobe Analytics to construct its own “digital price index” which shows much less inflation than official measures. For example, they find that furniture and bedding fell in price by almost 12% online between January 2014 and June 2019, while the official consumer price index records a fall of only 2.1%.

统计人员一直在与这个问题作斗争。但前政府高级官员布伦特·穆尔森(Brent Moulson)回顾了2018年美国通胀指数后认为,美联储的目标通胀指数仍然向上偏差了将近0.5个百分点,主要是因为新产品和质量变化。转向在线销售可能会让新产品造成的偏差愈发严重。斯坦福大学的奥斯坦·古尔斯比(Austan Goolsbee)和彼得·克莱诺(Peter Klenow)的论文发现,在信息技术公司Adobe Analytics提供的数据库中,即使不包括品味易变的服装,在线销售中有44%是上一年不存在的商品。更迭率如此之高,官方统计人员监控的一篮子商品很快就会过时。对于某些类别的商品,古尔斯比和克莱诺已经帮助Adobe Analytics构建了自己的“数字价格指数”,该指数显示的通胀率远低于官方指标。例如,他们发现家具和床上用品的在线价格在2014年1月至2019年6月期间下跌了近12%,而官方消费物价指数仅下跌了2.1%。

A bigger problem than falling prices is prices that are zero from the start. Most consumers today carry devices in their pockets with which they can make a video-call anywhere in the world, access information on any subject and translate languages instantaneously, all for free. The explosion in the provision of free services is usually cited as a reason to doubt the accuracy of GDP. But it is as big a problem for inflation. First, free services sometimes replace ones that were previously paid for, which puts new-product bias on steroids. Second, if consumers derive a greater share of their well-being from things that come free, inflation ceases to be a good measure of the cost of living or of the purchasing power of incomes.

比价格下跌更大的问题是价格从一开始就是零。如今,大多数消费者的口袋里都揣着设备,可以用来在世界任何地方进行视频通话,访问任何主题的信息并即时翻译语言,而所有这些都是免费的。人们常把免费服务的激增作为怀疑GDP准确性的一个原因。但这对通货膨胀来说也是个大问题。首先,免费服务有时会取代以前付费的服务,大大加剧了新产品偏差。第二,如果消费者从免费的东西中获得更多的幸福感,通胀就不再是衡量生活成本或收入购买力的良好标准。

The value of nothing

免费的价值

Measuring the price of something and measuring its value to consumers are two different tasks. Erik Brynjolffson of MIT and two co-authors have run experiments in an attempt to do the latter. They asked 3,000 online participants what they would need to be paid to give up Facebook for a month, offering to enforce the deal for a few randomly selected participants using Facebook features that reveal to friends when somebody last logged on. The median response was $42. About a fifth of users quoted somewhere near $1,000. In another experiment they struck similar agreements with participants at a Dutch university, enforcing the contract by getting users to change their passwords, in effect locking them out of their accounts, or to submit to monitoring of their electronic devices. The median figure participants quoted to give up mapping services for a month was about €59 ($64); for WhatsApp it was €536. In another paper Mr Brynjolffson and his colleagues asked consumers what they would need to be paid to forgo free online search engines for a year: the median response was over $17,500.

衡量一件东西的价格和衡量它对消费者的价值是两码事。麻省理工学院的埃里克·布林约夫森(Erik Brynjolffson)和两位论文合著者开展的实验尝试做第二件事。他们询问了3000名在线参与者,要付给他们多少钱才愿意放弃使用Facebook一个月,并向其中一些随机选择的参与者提出使用Facebook“向好友显示最近登录时间”的功能来执行协议。回复的中位数为42美元,而约五分之一的用户报价接近1000美元。在另一个实验中,他们与荷兰一所大学的参与者达成了类似的协议,通过让用户更改密码(相当于将其帐户锁定)或接受对其电子设备的监控来执行合同。参与者报价放弃一个月地图服务的中位数约为59欧元(64美元),放弃使用WhatsApp的报价为536欧元。布林约夫森和同事在另一篇论文中问消费者,放弃一年的免费在线搜索引擎需要支付他们多少钱:中位数报价超过17,500美元。

These figures can mislead. People will always fear the social isolation that would come with being cut off from the predominant communications technology of the day, whether it is telephones, texts or TikTok. Inflation and GDP were never intended to measure consumer welfare. Some free services are displacing activity which has never been counted in GDP, like casual matchmaking. Free services funded by advertising are not new: radio and television have been around a long time. And advertising is only small relative to the economy. John Fernald of the San Francisco Fed argues that many of the consumer benefits from modern technology are “conceptually non-market”.

这些数字可能会误导。人们永远都会担心用不上时下主流的通信技术会让自己与社会隔离,无论这种技术是电话、短信还是抖音。通胀和GDP从来都不是为了衡量消费者福利的。一些免费服务正在取代之前从未计入GDP的活动,例如非正式的相亲配对服务。依赖广告的免费服务并不是什么新鲜事:广播和电视已经存在了很长时间。相对于经济总量来说,广告的规模很小。旧金山联储的约翰·费纳尔德(John Fernald)认为,现代技术给消费者带来的许多好处“在概念上是非市场化的”。

Yet the line between market and non-market services is hazy. Imputed rent, the money homeowners would have to pay to rent a house equivalent to the one they own, is included in inflation and GDP, despite not representing any market transaction. In another recent paper David Byrne of the Federal Reserve and Carol Corrado of the Conference Board, a business group, argue that smartphones, broadband connections and Netflix subscriptions should be viewed as investments that reap variable dividends over time depending on how intensively they are used. Armed with trends in data usage and time-use surveys Mr Byrne and Ms Corrado construct a quality-adjusted price index for digital access services that shows prices falling by 21% between 2007 and 2017. The official price index for internet access, by contrast, shows prices up 4.5% over the same period.

然而,市场化服务与非市场化服务之间的界限也很模糊。“推定租金”,即房主租用与自己的房屋相当的物业时必须支付的钱,已被计入通胀和GDP中,尽管它不代表任何市场交易。联储的戴维·伯恩(David Byrne)和商业团体世界大型企业研究会(Conference Board)的卡罗尔·克拉多(Carol Corrado)在最近发表的另一篇论文中提出,应将智能手机、宽带连接和网飞(Netflix)订阅视为随时间流逝能获得可变股息的投资,股息则取决于使用强度。借助在数据使用和使用时间调查中发现的趋势,伯恩和克拉多构建了按质量调整后的数字访问服务价格指数,显示价格在2007年至2017年之间下降了21%。相比之下,官方发布的互联网访问价格指数显示同期价格上涨了4.5%。

The fact that inflation may be even lower than is reported is, in one respect, good news: it means that growth in living standards has been understated. But it is troublesome for central bankers who are already undershooting their inflation targets. Moreover, the justification for targeting inflation in the first place rests on the notion that the number is a meaningful representation of the economic experiences of the public and of firms. The more economic activity shifts into a domain where price is a slippery concept, the weaker that link will become. And there is another source of breakdown in economists’ understanding of how prices are formed: globalisation.

从某一个角度来说,通胀甚至可能比报道数字还要低是个好消息:这意味着生活水平的增长被低估了。但这对于通胀已经低于目标的央行行长们来说是个麻烦。此外,给通胀设定目标,其根本理由就是这个数字能够有意义地体现公众和企业的经济活动。而经济活动转移进价格概念靠不住的领域越多,这种关联性就越弱。经济学家对价格形成机制的理解出了问题还有另一个原因:全球化。