国际银行业

平行宇宙

专题作者马修·法瓦斯认为,地缘政治和技术正在将世界的一半拖离美国的金融轨道。新冠肺炎大流行正在加剧分裂

International banking

Parallel universe

Geopolitics and technology are pulling half the world away from America’s financial orbit, says Matthieu Favas. The covid-19 pandemic is precipitating a split

今年1月份,一位美国前上将在一个全球资深金融家聚会上发表了讲话。惯于思考战略和硬实力的他警告说,从伊朗和俄罗斯到新型冠状病毒,美国在应对它自冷战以来最复杂的一系列威胁时处理得很糟糕。但他还谈到了一个鲜为人知的威胁:通过积极使用经济制裁,美国如何滥用其作为金融强国的影响力,由此迫使盟友和敌人建立另外的金融体系。他说:“我不确定首席决策者是不是了解金融体系如何运作。” 一名前上将会思考全球金融体系的问题,本身就充分说明了这种危险已变得多么重大。

IN JANUARY AN American former general spoke at a gathering of senior global financiers. Used to thinking about strategy and hard power, he warned that America is dealing poorly with its most complex array of threats since the cold war—from Iran and Russia to the novel coronavirus. But he also spoke of a much less visible threat: how, through its aggressive use of economic sanctions, America is misusing its clout as the predominant financial power, thereby pushing allies and foes alike towards building a separate financial architecture. “I’m not sure of the decider-in-chief’s appreciation for how the financial system works,” he said. That a former general would be thinking about the global financial system says much about how significant that danger has become.

这一体系由机构、货币和支付工具组成,这些工具决定了支撑实体经济的无形流动性如何在世界范围内流转。自第二次世界大战以来,美国一直是它跳动的核心。但如今,一再的失误以及中国日益增长的吸引力已开始让这一体系撕裂。许多人认为现状太根深蒂固而无法受到挑战,但情况已不再如此。在新兴世界中正在形成一个独立的金融世界,具有不同的支柱和新的主人。

The system is made up of the institutions, currencies and payment tools that dictate how the invisible liquidity feeding the real economy flows around the world. America has been its pulsating centre since the second world war. Now, though, repeated missteps, and China’s growing pull, have begun to tear at the seams. Many assume the status quo is too entrenched to be challenged, but that is no longer the case. A separate financial realm is forming in the emerging world, with different pillars and a new master.

和地缘政治版图一样,金融版图上即将出现的霸主是中国,它的迅速崛起正在削弱该体系。如今,中国占到全球GDP的15.5%,而2000年时仅为3.6%。它已成为世界第二大经济体,深深植根于全球贸易的网络中。但它在金融体系中的影响力却很小。中国认为纠正这种失衡对于获得大国地位至关重要。智库RUSI的汤姆·基廷格(Tom Keatinge)说:“美元的主导地位正从下面被掏空。”新冠危机有可能给这种离心力推上决定性的一把。

The hegemon-in-waiting financially, as geopolitically, is China, whose rapid rise is tugging away at the system. The country today accounts for 15.5% of global GDP, up from 3.6% in 2000. Its economy, the world’s second-largest, is deeply woven within the fabric of global trade. Yet it weighs little in the financial system. China sees correcting this asymmetry as crucial to gaining great-power status. “The dollar dominance is being hollowed out from underneath,” says Tom Keatinge of RUSI, a think-tank. The covid-19 crisis threatens to give centrifugal forces a decisive boost.

该体系的第一根支柱在1944年铺设:在于新罕布什尔州的布雷顿森林举行的会议上,成立了世界银行、国际货币基金组织,确立了全球货币秩序。美国在整个战争期间向盟友提供军火,拥有了地球上大部分的黄金,并以此为军火定价。欧洲和亚洲很多地方都是一片废墟。事实证明,两次大战之间的浮动汇率制度功能失调。因此,人们决定将所有货币与美元挂钩,美元又与黄金挂钩。这使美元成为全世界的新储备货币。20年后,日本和德国日益增长的经济实力,加上美国在越战期间大量印钞,使这种固定汇率难以为继。该体系解体了,但“美元标准”留存了下来。

The system’s first pillar was laid in 1944 with the founding of the World Bank, the IMF and the global monetary order at Bretton Woods, New Hampshire. Having supplied weapons to allies throughout the war, America owned most of the planet’s gold, in which it priced its wares. Much of Europe and Asia lay in ruins. The interwar system of floating exchange rates had proved dysfunctional. It was thus decided that all currencies would be linked to the dollar, and the dollar tied to gold. That made the greenback the world’s new reserve currency. Two decades later the rising economic heft of Japan and Germany, coupled with vast money-printing by America during the Vietnam war, made the pegs untenable. The system disintegrated, but the “dollar standard” survived.

在1970年代,美国还掌控了支撑全球支付的底层系统。当时美国的银行被禁止在州境之外运营,于是联合起来开发了银行间消息系统和全国性的ATM网络。贷款机构也聚集在一起成立信用卡系统,即负责制定规则和体系的协会,让会员用塑料卡片付款。当两个主要的信用卡网络(很快改名为“维萨”和“万事达”)收购了两家最大的ATM公司以向海外扩张时,所有这些系统合并在了一起。银行卡和自动取款机让个人得以在任何地方购物,成为在全球各地转移小额款项的主要基础设施。

In the 1970s America also gained sway over the plumbing system that underpins global payments. American banks, then barred from operating outside state borders, teamed up to develop interbank messaging systems and nationwide ATM networks. Lenders also clubbed together to form credit-card “schemes”—associations setting the rules and systems through which members settle payments in plastic. Those worlds merged when two major card networks (soon rechristened Visa and MasterCard) bought the two largest ATM firms to expand overseas. By allowing individuals to shop anywhere, cards and cash machines became the dominant infrastructure for moving small sums of money across the world.

大额转账很快也发生了一场革命。在旧有的电汇系统中,银行之间的跨境付款需要以自由文本交换十几条消息,而这一过程容易发生人为错误。1973年,一批银行联合创立了SWIFT,这是一种自动消息服务,为每个银行分支机构分配唯一的代码。它成了批发支付的通用语言。

A revolution soon ensued in large-value transfers. In the old “telex” system, a cross-border payment between banks required the exchange of a dozen messages in free text, a process prone to human error. In 1973 a group of banks joined to create SWIFT, an automated messaging service assigning a unique code to every bank branch. It became the lingua franca for wholesale payments.

新技术推动了美国银行业的发展,在纸面资产数字化的帮助下,这些银行变得更有能力适应海外客户及其资本市场。重建后,拥有丰富储蓄的日本和德国将手中的美元存放在美国国债中。房地产热潮催生了资产支持证券。从1980年到2003年,美国的证券存量从GDP的105%增长到GDP的三倍,成为美国投资银行的国际跳板。在1990年代的监管大爆发之后,这些投资银行与商业银行合并。到2008年,35家公司变成了四大——花旗集团、富国银行、摩根大通和美国银行,它们是美国金融主导权仅存的硕果。

New technology boosted America’s banks, which became better equipped to follow clients overseas, and its capital markets, helped by the digitalisation of paper assets. Having rebuilt, savings-rich Japan and Germany parked their dollars in treasury bonds. A housing boom spawned asset-backed securities. Between 1980 and 2003, America’s stock of securities grew from 105% to three times GDP, forming the international springboard for its investment banks. After a regulatory big bang in the 1990s, they merged with commercial banks. By 2008, 35 firms had become the big four—Citigroup, Wells Fargo, JPMorgan Chase and Bank of America—the last prong of America’s financial dominance.

美国在这个体系内的吸引力仍然很大。当灾难来袭时,美元飙升。它仍然是世界上最安全的价值存储方式及主要交换手段。这让铸造美元的机构成了全球市场的节拍器。2008年,美联储通过向富裕国家的中央银行提供“掉期额度”,使它们能够以自己的货币借入美元,从而避免了全球范围内的现金紧缩。当今年3月市场再次陷入恐慌时,美联储将这一操作扩大到了一些新兴国家。4月,它进一步扩大范围,允许大多数央行和国际机构将美国债务证券兑换成美元,从而防止了挤兑。

America’s pull within the system remains huge. When disasters strike, the dollar surges. It is still the world’s safest store of value and its chief means of exchange. That makes the institution that mints it the metronome of global markets. In 2008 America’s Federal Reserve avoided a general cash crunch worldwide by offering “swap lines” to rich-world central banks, allowing them to borrow dollars against their own currencies. When panic gripped markets again this March, the Fed expanded the offer to some emerging countries. In April it widened it further, allowing most central banks and international institutions to exchange their American debt securities against greenbacks, thus stalling the stampede.

全世界的底层金融系统也仍然在美国的掌控之下。SWIFT的11,000名全球成员每天互相发送三千万次消息。它们进行的大多数国际交易最终都由美国“代理”银行通过纽约转发给CHIPS这个每天结算1.5万亿美元支付的清算所。数据公司“尼尔森报告”(Nilson Report)称,维萨和万事达处理了全球三分之二的银行卡付款。美国的银行收取了全球投资银行业务费用的52%。

The world’s financial plumbing remains under America’s thumb, too. SWIFT’s 11,000 members across the world ping each other 30m times daily. Most international transactions they make are ultimately routed through New York by American “correspondent” banks to CHIPS, a clearing house that settles $1.5trn of payments a day. Visa and Mastercard process two-thirds of card payments globally, according to Nilson Report, a data firm. American banks capture 52% of the world’s investment-banking fees.

一切都改变

三件事正在推动变革。首先,地缘政治的“推动”因素。美国的中心地位让它可以通过阻止竞争者获得全球的流动性供应来让它们寸步难行。不过它一直克制住没有这样做,直到近些年。过去金融体系被视为促进贸易和繁荣的中立性基础设施。第一批裂痕出现在2001年之后,当时美国开始用该体系掐断恐怖主义的资金。有组织犯罪和核扩散者不久就被加入了黑名单。相关计划把这些群体描绘成对国际安全和金融体系完整性的威胁,以此说服了盟友,小布什的前顾问、该计划最初的设计者胡安·扎拉特(Juan Zarate)说。

All change

Three things are driving change. First, the “push” factor of geopolitics. America’s centrality allows it to cripple rivals by denying them access to the world’s liquidity supply. Yet until recently it refrained from doing so. The financial system was seen as neutral infrastructure for promoting trade and prosperity. The first cracks appeared after 2001, when America started using it to choke funding for terrorism. Organised crime and nuclear proliferators soon joined the list. It persuaded allies by presenting such groups as threats to international security and the integrity of the financial system, says Juan Zarate, a former adviser to George W. Bush who designed the original programme.

这套工具在奥巴马的领导下获得了强大的影响力。俄罗斯在2014年入侵克里米亚之后,美国处罚了一个体量是先前目标两倍的经济体的寡头、公司和整个行业。美国还对与黑名单上的实体做交易的其他国家的公司实施了“次级”制裁。此后,特朗普总统将该系统用作武器,并用于对抗盟国。去年12月,它瞄准了铺设管道将俄罗斯天然气引入欧洲的公司。今年3月,它加强了对伊朗的制裁,即使其他国家向伊朗提供了援助。这个武器库看起来并不是一视同仁的:自2008年以来,美国的罚款总额为290亿美元,其中对欧洲银行的罚款达220亿美元。吉布森律师事务所(Gibson Dunn)的亚当·史密斯(Adam Smith)说,在2019年它指定新制裁目标共计82次。

The arsenal gained potency under Barack Obama. After Russia’s invasion of Crimea in 2014, America punished oligarchs, companies and entire sectors of an economy twice the size of previous targets. “Secondary” sanctions were imposed on other countries’ companies that traded with blacklisted entities. President Donald Trump has since elevated the system for use as a weapon and used it against allies. In December it targeted firms building a pipeline bringing Russian gas into Europe. In March it toughened sanctions against Iran even as others channelled aid to the country. The arsenal hardly feels impartial: since 2008 America has fined European banks $22bn, out of $29bn in total. In 2019 it designated new sanction targets 82 times, says Adam Smith of Gibson Dunn, a law firm.

现在,制裁被越来越多地与其他限制措施联合使用以压制中国。美国商务部列有一大堆其他公司不能与之交易的实体清单。其中之一是“未经核实”清单,禁止向商务部视为有疑问的公司出口产品。列表中的名字从2016年的51个增加到今年3月的159个。中国实体占到了新增实体的三分之二。其他部门也竞相做出对中国强硬的姿态。

Sanctions are now increasingly used in conjunction with other restrictions to throttle China. The Department of Commerce maintains a jumble of lists of entities with which other firms cannot deal. One of them, the “unverified” list, bans exports to companies about which the ministry has questions. It has grown from 51 names in 2016 to 159 in March. Chinese entities make up two-thirds of additions. Other departments are also racing to be seen as the toughest on China.

在短期内,整个系统不透明的性质放大了制裁的影响。但是,这也极大地刺激了其他人寻求变通和规避的办法,而技术越来越多地提供了构建它们所需的工具。

In the short run the opaque nature of the whole system maximises the impact of sanctions. But it also creates a strong incentive for others to seek workarounds, and technology is increasingly providing the tools needed to build them.

这些进步来自于新趋势的第二个驱动力:试图满足新兴经济体需求的“拉动”因素。科技公司将目光投向了全球几乎无法获得金融服务的23亿人口。在充足资金和宽松规定的帮助下,它们创建了运营成本低廉的系统并开始输出。有些还希望在信用卡罕见但手机普及的地区支持贸易。在庞大国内市场的支撑下,中国的“超级应用程序”上运行的生态系统让用户无需使用现金就可进行消费。

Such advances result from the second driver of the new trends: the “pull” factor of attempts to meet the needs in emerging economies. Tech firms have sights on the world’s 2.3bn people with little access to financial services. Helped by plentiful capital and permissive rules, they have created cheap-to-run systems they are starting to export. Some also aim to enable commerce in regions where credit cards are rare but mobile phones common. Propped up by their huge home market, China’s “superapps” run ecosystems in which users spend their way without using actual money.

许多新兴市场(不仅仅是中国)都渴望实现经济再平衡,这一点也有助于变化。这些市场大多在国外借款,并以美元为其出口定价。美国曾经是它们最大的买家。每当美元上涨,需求就会随之增加,弥补了更为昂贵的债务。但现在,强势美元升值意味着它们的主要贸易伙伴中国能买得起的东西更少了。因此在还贷变得更昂贵的同时,需求也下降了。而且风险也增加了:新兴市场的美元债务存量自2010年以来翻了一番,达到3.8万亿美元。

It helps that many emerging markets, not just China, are keen on a rebalancing. Most borrow abroad, and price their exports, in dollars. America was once the biggest buyer. Whenever the dollar rose, demand would follow, making up for costlier debt. But a stronger dollar now means China, their chief trading partner, can afford less stuff. So demand falls just when repaying loans gets dearer. And the stakes have risen: emerging markets’ stock of dollar debt has doubled since 2010, to $3.8trn.

助力“叛变者”的第三个因素是新冠肺炎,它可能会将事情引至临界点。已经因关税上涨而步履蹒跚的全球贸易很可能会变得愈发支离破碎。由于远方的生产中断会导致本地短缺,各地政府现在希望缩短供应链。这将为中国这样的地区大国提供更多空间来制订自己的规则。对美国的经济影响——尤其是其2.7万亿美元刺激计划的财政影响——可能削弱人们对其偿债能力的信心,而这是其债券和货币的根基。

The third factor helping insurgents is covid-19, which could lead to a tipping-point. Already hobbled by rising tariffs, global trade is likely to fragment further. As disruption far away causes local shortages, governments want to shorten supply chains. That will give regional powers like China more room to write their own rules. The economic fallout in America—not least the fiscal impact of its $2.7trn stimulus measures—could dent confidence in its ability to repay debt, which underpins its bonds and currency.

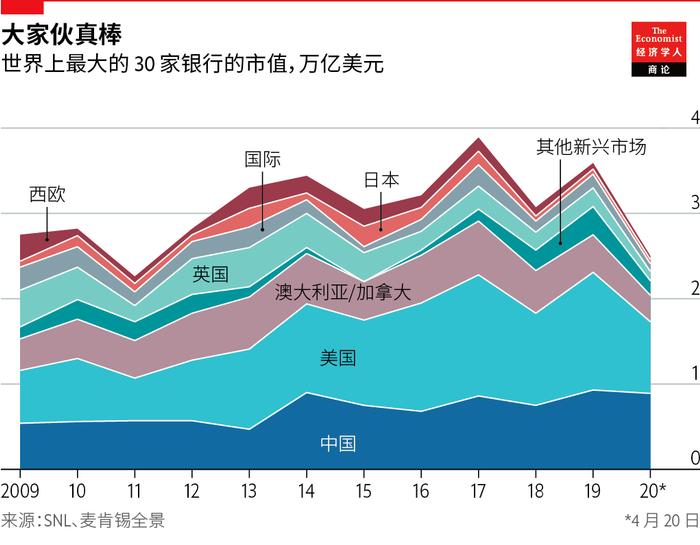

最重要的是,这场危机损害了其他国家对美国领导能力的信任。它无视预警,最初的应对一团糟。中国犯下了更严重的错误——其自身的失误首先帮助把新冠肺炎传到了国外。但它设法迅速遏制住了病毒传播,现在正四处宣扬其国内治理能力。美国保证全球繁荣的能力是维持金融秩序的粘合剂。随着这一角色的正当性受到严重打击,针对该体系的新一轮攻击似乎不可避免。首当其冲的是美元体系的步兵——银行。

Most important, the crisis harms other countries’ trust in America’s fitness to lead. It ignored early warnings and botched its initial response. China is guilty of worse—its own missteps helped export covid-19 in the first place. Yet it managed to curb cases fast and is now broadcasting a narrative of domestic competence. America’s ability to guarantee global prosperity is the glue that holds the financial order together. With its legitimacy badly hit, renewed assaults on the system seem inevitable. On the front line are the dollar-system’s foot soldiers, the banks.